Post Office FD Scheme 2026 Update: Saving money is not just about earning returns, it is also about sleeping peacefully at night knowing your funds are secure. That is why the Post Office Fixed Deposit scheme continues to hold a strong place in Indian households. With the 2026 update, this government-backed savings option has once again come into focus. Investors looking for stability, predictable income, and long-term trust are closely watching how Post Office FDs fit into their financial plans this year.

Why Investors Trust It

The Post Office FD scheme carries the assurance of sovereign backing, which immediately builds confidence among investors. Unlike market-linked products, this scheme does not fluctuate with economic ups and downs. In 2026, when uncertainty still affects many investment avenues, this trust factor becomes even more valuable. For people who prefer certainty over speculation, Post Office FDs continue to represent financial discipline and long-term reliability.

Interest Rates Draw Attention

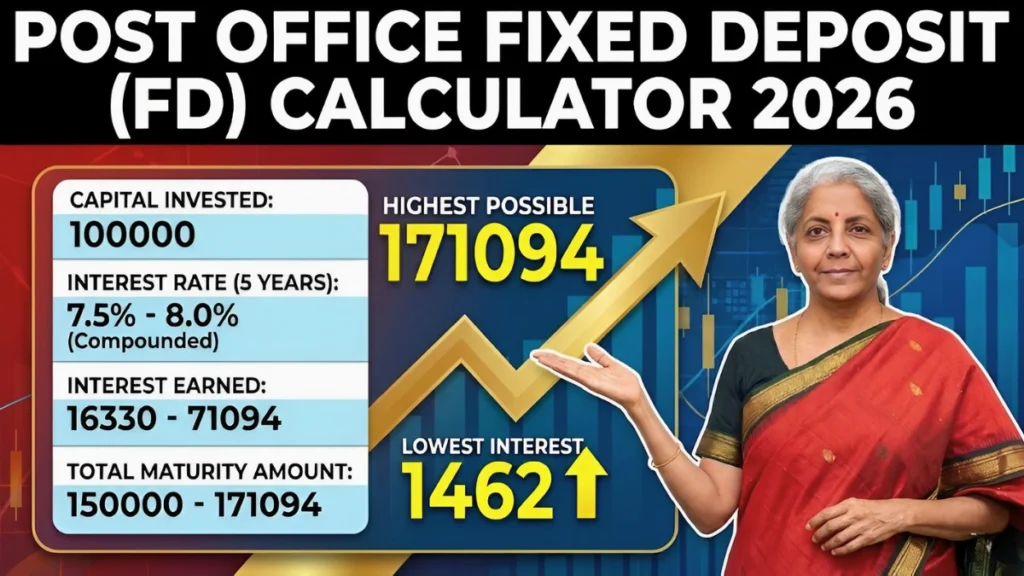

The 2026 update keeps Post Office FD interest rates competitive and aligned with broader economic trends. While the rates may not always top the charts, they remain attractive for investors who value safety over aggressive returns. Different tenures offer varying interest benefits, allowing savers to plan wisely. This balance between decent returns and strong security makes the scheme appealing in a cautious investment environment.

Multiple Tenure Choices

Flexibility is a key strength of the Post Office FD scheme. Investors can choose deposit periods ranging from short-term to longer durations, depending on their goals. Whether someone wants to park surplus cash for a year or lock in savings for five years, the scheme offers suitable options. This freedom helps align investments with personal milestones such as education costs, retirement planning, or future purchases.

Easy Account Opening

Opening a Post Office FD remains simple and accessible even in 2026. Investors can visit a nearby post office with basic identification and address proof. Many branches now support digital payments and faster processing, reducing waiting time. This ease of access is especially helpful for senior citizens and first-time investors who may not be comfortable navigating complex financial platforms or online-only systems.

Tax Benefits Explained

Taxation plays a crucial role in fixed deposit decisions. Interest earned from Post Office FDs is taxable according to the investor’s income slab. However, the five-year Post Office FD stands out by offering tax deduction benefits under Section 80C. This feature makes it attractive for taxpayers aiming to save tax while maintaining capital safety. Understanding this aspect can significantly improve overall post-tax returns.

Safe Haven During Uncertainty

In times when markets behave unpredictably, Post Office FDs act as a financial anchor. The guaranteed return structure ensures that investors are not exposed to sudden losses. The 2026 financial landscape continues to experience global and domestic shifts, making stable instruments more relevant. For those who prioritize peace of mind, this scheme offers reassurance without the stress of daily market tracking.

Post Office vs Bank FDs

Comparing Post Office FDs with bank fixed deposits is common among investors. While some banks may offer slightly higher interest rates, they may also come with changing policies or perceived risk. Post Office FDs stand firm due to government backing and uniform rules. For conservative investors, the difference often lies not in returns alone, but in long-term confidence and consistency.

Liquidity Rules Matter

Liquidity is an important consideration for any fixed deposit. Post Office FDs allow premature withdrawal under specific conditions, usually with a modest penalty. This feature offers flexibility during emergencies without completely locking away funds. In 2026, investors are paying closer attention to such rules, ensuring their money remains accessible when unexpected financial needs arise.

Who Should Invest

The Post Office FD scheme suits a wide range of investors. Retirees looking for stable income, salaried individuals seeking low-risk savings, and families planning secure funds for future expenses can all benefit. It also works well as a diversification tool within a broader portfolio that includes higher-risk investments. This versatility keeps the scheme relevant across age groups and income levels.

Final Word: Post Office FD Scheme 2026 Update

The Post Office FD Scheme 2026 update reinforces its reputation as a dependable and steady investment choice. While it may not promise rapid wealth creation, it delivers something equally important: certainty and trust. For investors who value safety, predictable returns, and simplicity, Post Office FDs remain a smart financial move. In an ever-changing investment world, this scheme continues to stand as a symbol of stability and confidence.

Disclaimer: This article is for informational purposes only. Interest rates, rules, and benefits may change. Readers should verify details with official Post Office sources or consult a financial advisor before investing.